Average percentage of taxes taken out of paycheck

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Ad Get the Paycheck Tools your competitors are already using - Start Now.

2022 Federal Payroll Tax Rates Abacus Payroll

How do I calculate taxes from paycheck.

. Amount taken out of an average biweekly paycheck. These amounts are paid by both employees and employers. For each pay period your employer will withhold 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

These amounts are calculated and deducted from earnings after all pre-tax. 4 rows Current FICA tax rates. In other words for every 100 you earn you actually receive 6760.

62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. If you are self-employed you are responsible for paying the full 29 in Medicare taxes and 124 in Social Security taxes yourself. Ad Choose From the Best Paycheck Companies Tailored To Your Needs.

Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W. Having a consistent paycheck with a perk that devoid of tax. These are contributions that you make before any taxes are withheld from your paycheck.

The employer portion is 15 percent and the. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Choose Your Paycheck Tools from the Premier Resource for Businesses.

1 2022-- Pay Grades O-1 O-2 O-3 O-4 and O-5. How much you pay in federal income taxes depends on. The other 3240 is taken.

Worker was 774 of their gross wage compared with the OECD average of 754. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. Amount taken out of an average biweekly.

Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. The average marginal tax rate is 259 while the average tax rate is 169 as stated above. The Medicare tax rate remains 145 percent on the first.

The following military pay scale is. Total income taxes paid. Oklahoma income tax rate.

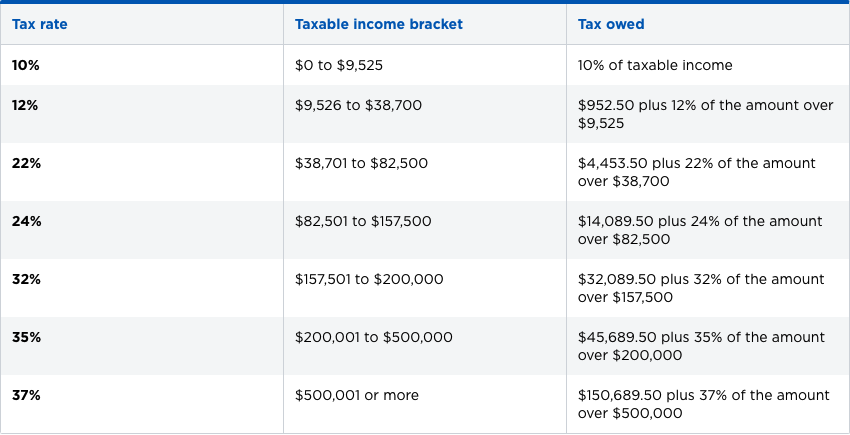

Federal income taxes are paid in tiers. Your 2021 Tax Bracket To See Whats Been Adjusted. This gives you your take home pay as a percentage of gross pay per pay period.

Since income tax rates vary from state to state however the size of that bite will fluctuate depending on where you live. Census Bureau Number of cities that have local income taxes. For a single filer the first 9875 you earn is taxed at 10.

The Social Security tax is 62 percent of your total pay until you reach an annual. You pay the tax on only the first 147000 of your. Compare Your 2022 Tax Bracket vs.

The Heart of Dixie has a progressive income tax rate in which the. Overview of Alabama Taxes. Oklahoma Paycheck Quick Facts.

Additionally the FICA and State Insurance Taxes would take away 790 for a tax deduction. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. FICA taxes consist of Social Security and Medicare taxes.

Alabama has income taxes that range from 2 up to 5 slightly below the national average. Also Know how much in taxes is taken out of my paycheck. Together these are called FICA taxes and your.

For 2022 employees will pay 62 in Social Security on the. Simplify Your Day-to-Day With The Best Payroll Services. For instance for year 2022 the Social Security tax rate in the United States remained 62 percent on the first 137700 of wages paid.

The current tax rate for social security is 62 for the employer and. Meanwhile after taxes and benefits the take-home pay of an average single US. Every employee is taxed at 62 percent for Social Security and 145 percent for Medicare.

OFFICER PAY RATES Basic Pay. In Tennessee for example only 1806 of your. Ad Discover Helpful Information And Resources On Taxes From AARP.

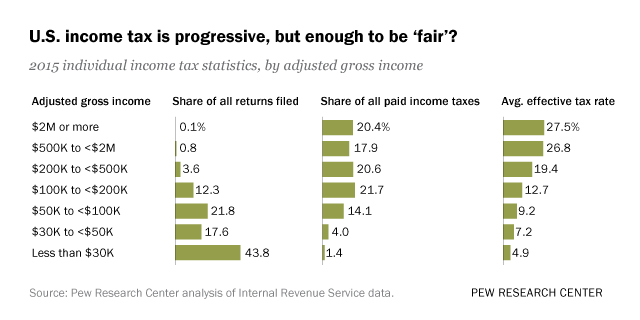

Who Pays U S Income Tax And How Much Pew Research Center

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Federal Income Tax Brackets Brilliant Tax

Average U S Income Tax Rate By Income Percentile 2019 Statista

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Who Pays U S Income Tax And How Much Pew Research Center

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Budgeting For Beginners A Free Step By Step Guide Budgeting Finances Budgeting Budgeting Money

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

2022 Federal State Payroll Tax Rates For Employers