51+ The Predetermined Overhead Rate Is Calculated ______.

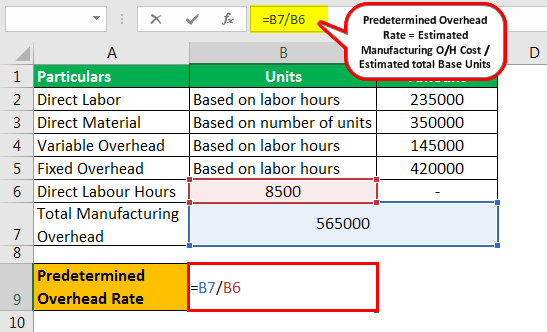

In the coming year the company expects the total overheads. Web The total manufacturing overhead cost will be the variable overhead plus fixed overhead.

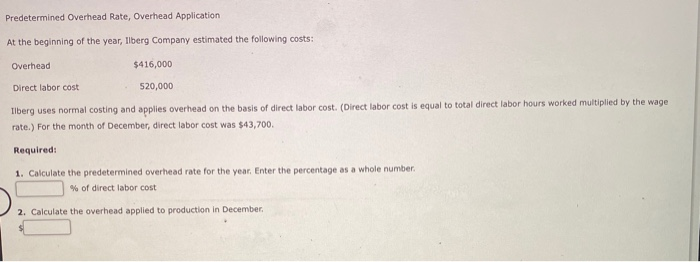

Solved Predetermined Overhead Rate Overhead Application At Chegg Com

Indirect Cost Activity Driver Overhead Rate Lets say your business had 850000 in overhead costs for 2019 with.

. The predetermined overhead rate is calculated O A. Web Predetermined overhead rate 160004000 hours 400 per direct labor hour Notice that the formula of predetermined overhead rate is entirely based on. Web View Test Prep - ch4 quiz with answers and explanations from ACCT 4673 at University of Arkansas.

To do this you would use the following formula. The estimated manufacturing overhead cost is 9000. The estimated total units in the.

Web A predetermined overhead rate is used by businesses to absorb the indirect cost in the cost card of the business. Web The standard overhead cost formula is. Lets say there is a company ABC Ltd.

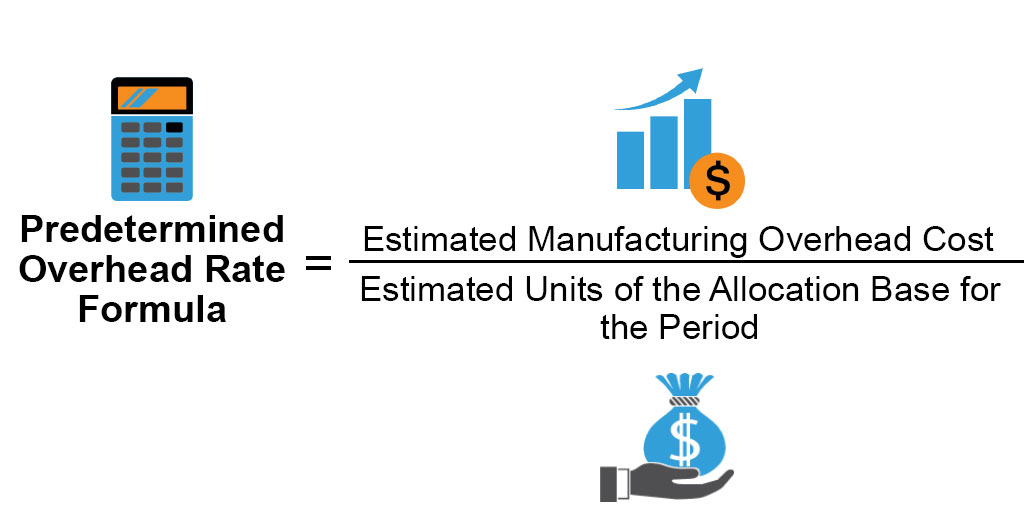

POH allocation rate based on estimates. The next step is to calculate a. A pre-determined overhead rate is the rate used to apply.

Its a budgeted rate that is calculated by budgeted inputs. After actual overhead costs have been. Calculate the predetermined OH rate POH 2nd.

Web Another way to calculate your predetermined overhead rate is by using a percentage of direct labor costs. The estimated labor hours are 3100 hours. Web The accountant has calculated estimated manufacturing overhead expenses.

Web The steps to calculate the predetermined overhead rate are as follows. Multiple POH by actual production APMOH What is a predetermined OH rate. Web A pre-determined overhead rate is the rate used to apply manufacturing overhead to work-in-process inventoryThe pre-determined overhead rate is calculated before the period.

Which uses Labour Hours as the base for allocation of Overheads. That is to say. Web To calculate estimated manufacturing overhead you use the formula.

A predetermined overhead rate is calculated using which of the following. Salaries rent depreciation tax estimated manufacturing overhead The total.

Predetermined Overhead Rate Formula Calculator With Excel Template

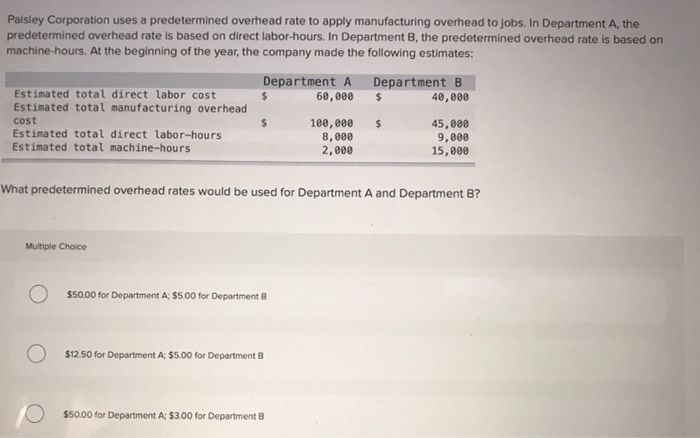

Solved Paisley Corporation Uses A Predetermined Overhead Chegg Com

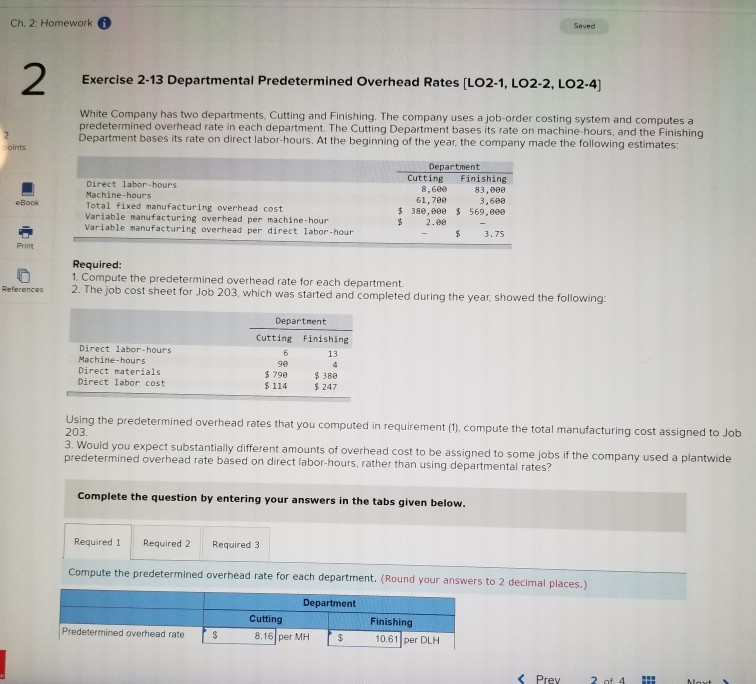

Solved Ch 2 Homework Saved 2 Exercise 2 13 Departmental Chegg Com

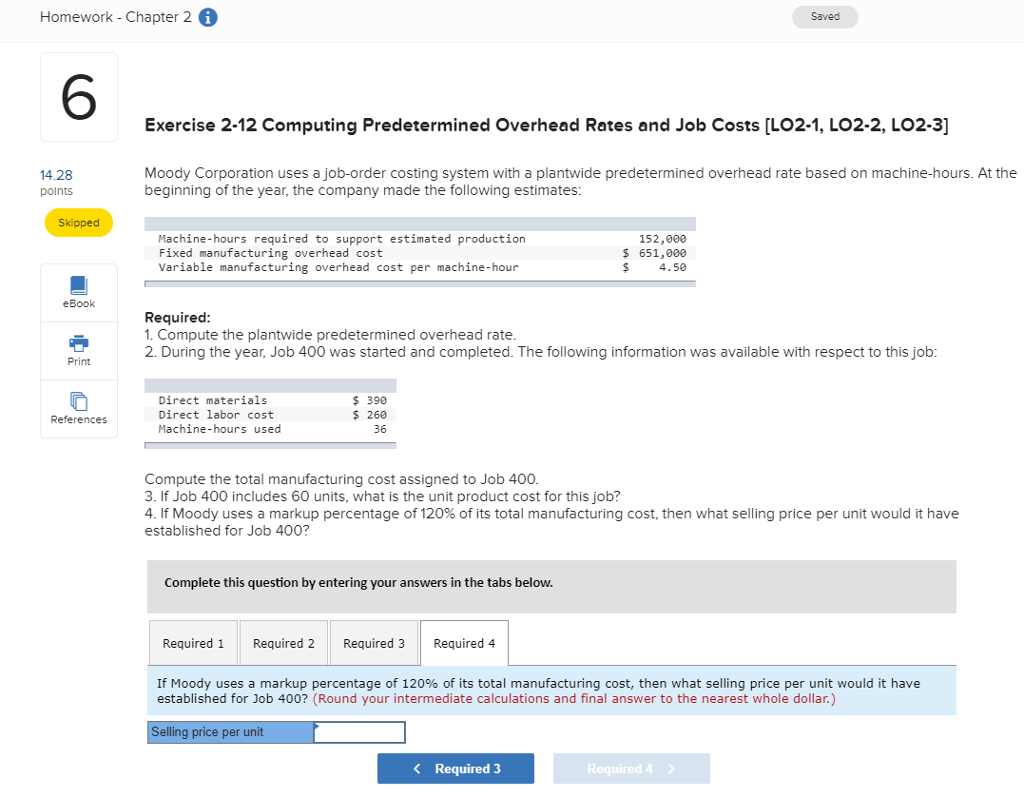

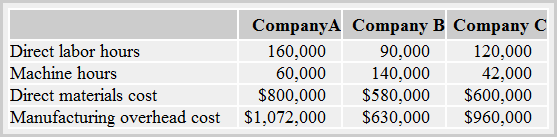

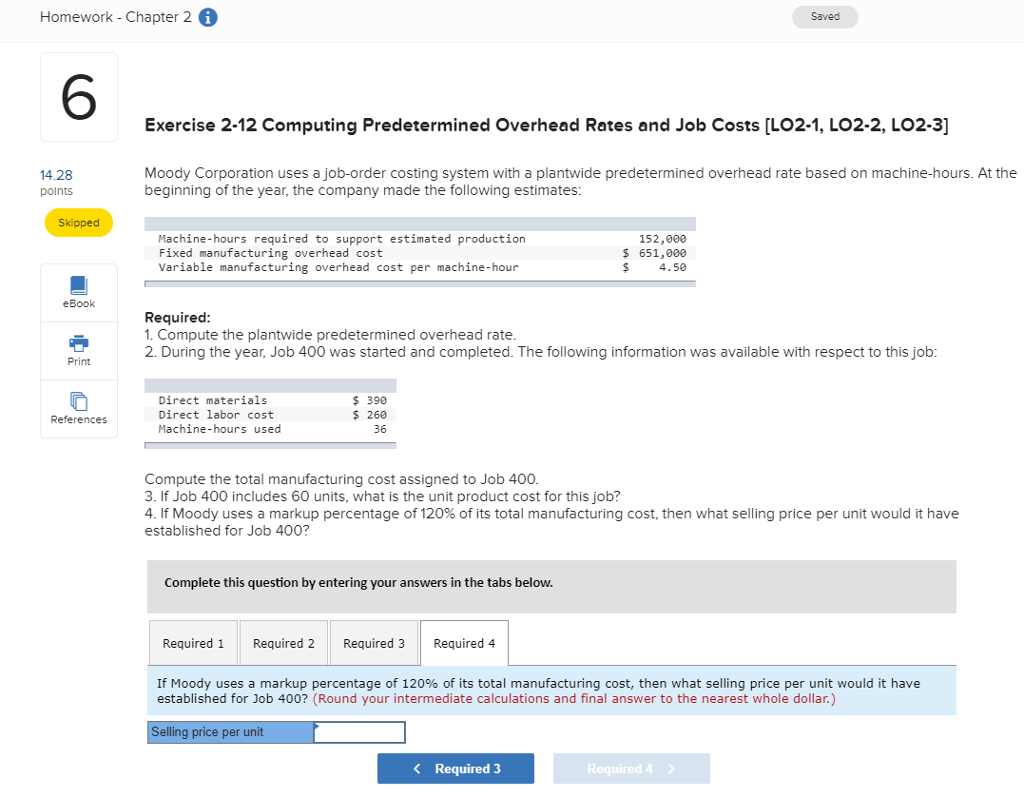

Solved Exercise 2 12 C Mputing Predetermined Overhead Rates Chegg Com

Predetermined Overhead Rate Formula Explanation And Example Accounting For Management

Predetermined Overhead Rate Formula How To Calculate

Predetermined Overhead Rate Pdf

Predetermined Overhead Rate Formula Explanation And Example Accounting For Management

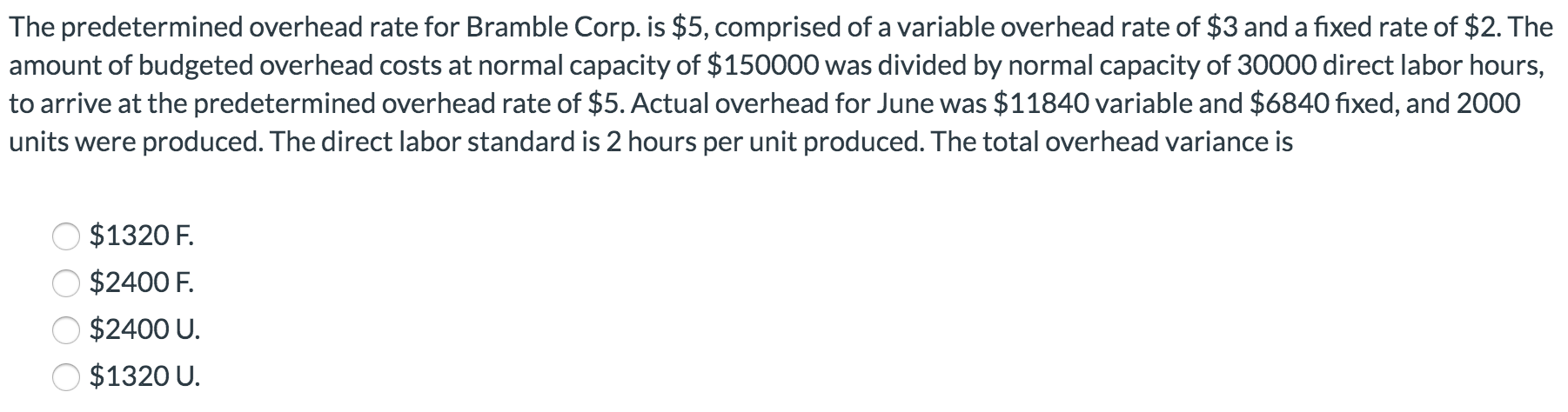

Solved The Predetermined Overhead Rate For Sheridan Company Chegg Com

Solved Homework Chapter 2 6 Saved 6 Exercise 2 12 Chegg Com

4 The Predetermined Overhead Rate Is Computed By Dividing Estimated A Level Of Course Hero

Note To Users

Studies On Improved Practices Of Prawn Farming For Higher

Accounting 2 Chapter 2 Flashcards Quizlet

Acc Chapter 2 Compute A Predetermined Overhead Rate Flashcards Quizlet

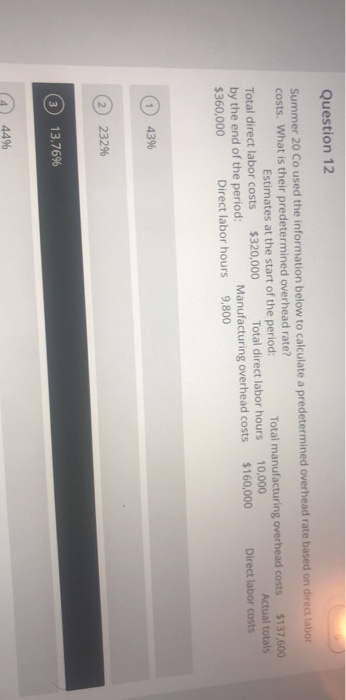

Solved Question 12 Summer 20 Co Used The Information Below Chegg Com

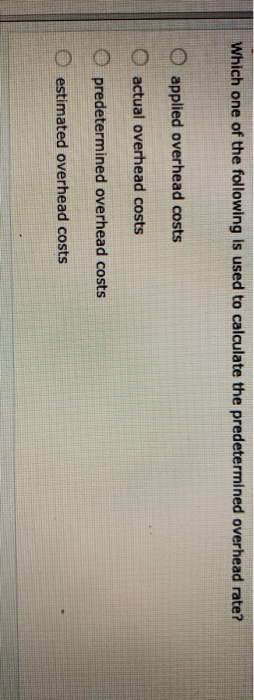

Solved Which One Of The Following Is Used To Calculate The Chegg Com